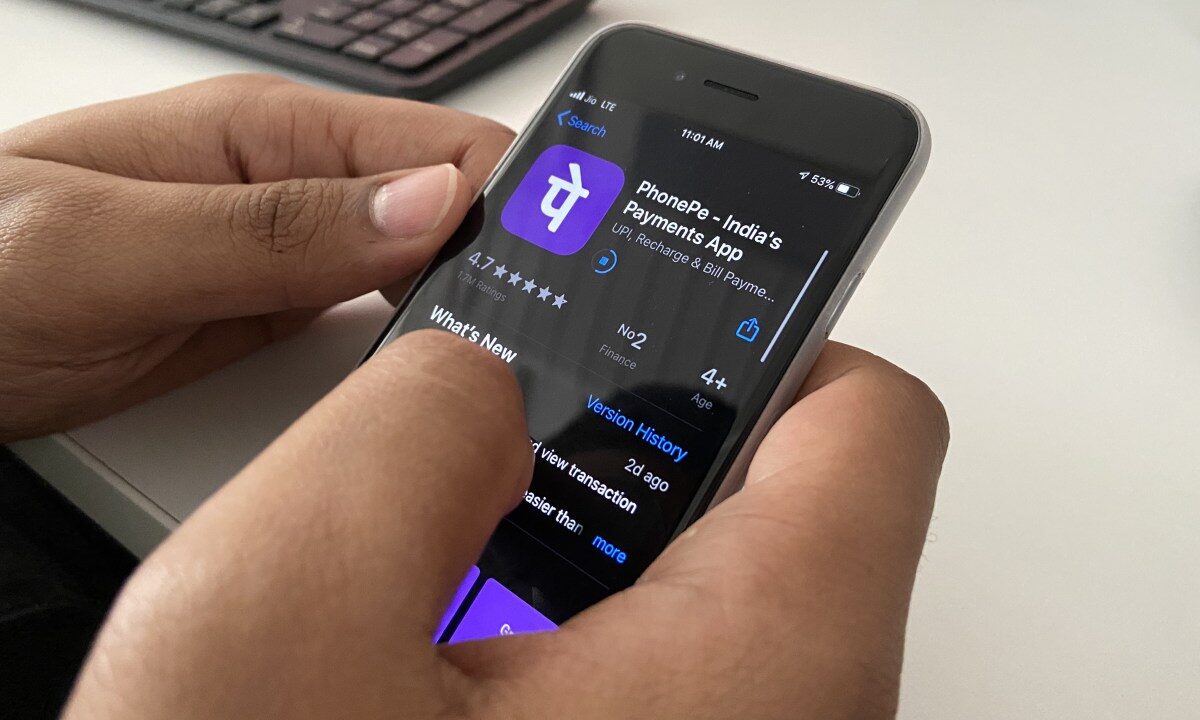

Tiger Global and Microsoft to Fully Exit PhonePe via Its Upcoming IPO

After years of backing the fast‑growing Indian fintech, two of its biggest investors are set to cash out entirely as PhonePe prepares to go public.

PhonePe’s ascent from a modest QR‑code payment app in 2016 to India’s third‑largest digital wallet illustrates how the country’s digital‑payments market can transform in under a decade. Built by former Flipkart engineers, the platform captured the post‑demonetization surge, enabling over 200 million active users and processing more than 5 billion transactions in 2024 alone. Its valuation, pegged at $13‑15 billion after the most recent Series F round, reflects not only user traction but also strategic backing from retail giants and global tech investors. For readers, understanding PhonePe’s scale helps contextualize why its shareholders now choose a full exit through an IPO.

Walmart’s role in PhonePe’s story began in 2019 when the retail behemoth, fresh from acquiring a 77 % stake in Flipkart, injected capital into the wallet’s ecosystem to deepen its e‑commerce tie‑ins. The partnership meant PhonePe merchants could receive payments instantly, while Walmart leveraged the wallet’s data to refine its supply‑chain logistics and consumer insights. This alignment turned PhonePe into a strategic lever for Walmart’s omnichannel ambitions in India, where grocery sales through Flipkart grew by 25 % year‑over‑year thanks in part to seamless checkout experiences powered by PhonePe.

Tiger Global entered the scene during PhonePe’s early expansion phases, taking a minority stake in 2017 before participating in subsequent rounds. Known for early‑stage fintech bets, Tiger Global placed PhonePe alongside digital‑insurance and credit‑scoring startups, betting on the platform’s ability to capture cash‑less transactions amid regulatory push‑back. The firm’s entry price, disclosed in 2018 filings, placed its ownership stake at roughly 5 % of the company’s equity. As PhonePe’s user base ballooned, Tiger Global’s position appreciated, creating a sizable unrealized gain that the firm now eyes to lock in before the market consolidates.

Microsoft, meanwhile, joined the PhonePe investor pool in 2020, co‑investing with a consortium that included Walmart and SoftBank Vision Fund. The tech giant’s focus was less on immediate returns and more on integrating PhonePe’s payment API with its Azure cloud services and expanding its exposure to India’s burgeoning fintech market. Microsoft’s stake, after the 2022 Series F round, hovered around 3 % of the equity, translating into a $400‑$500 million valuation at that time. The company’s strategic interest also included data‑analytics collaborations that could inform AI‑driven fraud detection models.

The IPO is slated for the first half of 2026, with regulatory filings expected to list PhonePe under the “Consumer FinTech” category. Investment banks slated for the offering—Goldman Sachs, Morgan Stanley, and HDFC Bank’s merchant banking arm—have hinted at a public valuation between $15 billion and $18 billion, reflecting recent growth metrics and a healthy cash‑flow runway. The timing coincides with a broader Indian stock‑market optimism driven by easing inflation, rising consumer disposable income, and a surge in IPO activity across the fintech space, making the debut attractive for both issuers and retail investors.

Both Tiger Global and Microsoft plan to sell their entire holdings in the IPO, a move analysts label a “full exit” because it eliminates any lingering equity exposure. The firms will route proceeds into flagship funds: Tiger Global toward its Global Growth Fund, and Microsoft toward its Innovation Fund that backs AI and cloud‑first startups. Their decision underscores confidence in PhonePe’s market position while allowing the investors to redeploy capital in emerging sectors where higher upside potential remains.

Walmart’s strategic calculus is nuanced. While the retailer does not intend to sell its stake, its partnership with PhonePe will evolve into a tighter integration with Flipkart’s commerce ecosystem. Analysts expect Walmart to accelerate cross‑selling initiatives—offering PhonePe‑linked loyalty rewards, instant credit, and data‑driven promotions—that could lift Flipkart’s GMV (gross merchandise value) by 5‑7 % over the next two fiscal years. The exit of Tiger Global and Microsoft therefore frees Walmart from external shareholder pressure, granting it unilateral control over the wallet’s feature roadmap and revenue allocation.

Market sentiment around the exit is cautiously bullish. Institutional investors cite PhonePe’s deep market penetration, a proven track record of incremental monthly ARPU (average revenue per user) growth, and a robust product suite—including credit lines, insurance, and a grocery marketplace—that differentiates it from rivals like Google Pay and Paytm. However, concerns linger about heightened competition, regulatory scrutiny on data‑localization, and the possibility of a valuation correction if the IPO under‑performs relative to peers such as Stripe and Square’s recent Indian spin‑offs.

For the broader Indian digital‑payment ecosystem, PhonePe’s IPO acts as a bellwether. A successful debut validates the hypothesis that homegrown fintechs can scale to multinational standards while adhering to local data‑privacy norms. It also incentivizes other fintech startups to pursue public listings, potentially unlocking a secondary market for early‑stage venture capital investors and increasing liquidity for retail shareholders. Simultaneously, the exit of global players like Tiger Global and Microsoft signals that the “first‑wave” investors are now re‑balancing portfolios toward AI‑heavy and sustainability‑focused ventures, a trend echoed across Southeast Asia.

Looking ahead, PhonePe’s post‑IPO growth hinges on three pillars: deepening merchant adoption, expanding cross‑border payments, and monetizing data through AI‑enhanced credit scoring. The company has already secured partnerships with leading Indian banks for a “buy‑now‑pay‑later” service and is piloting QR‑code integration with small‑store chains outside metros. Analysts forecast a 15 % compound annual growth rate (CAGR) in transaction volume over the next five years, driven by a projected 30 % increase in urban smartphone penetration and government incentives for digital‑cash initiatives.

Investors should note that while the IPO offers liquidity, it also raises expectations for transparency. PhonePe will need to disclose detailed financial metrics, customer acquisition costs, and repayment rates for its credit products—information currently shielded under private‑fund reporting. Meeting or exceeding these disclosures will be critical for maintaining its brand trust and justifying the premium valuation placed by underwriters.

PhonePe’s upcoming IPO marks a pivotal moment for India’s fintech narrative, turning a private‑equity darling into a public‑market contender backed by global tech titans. The full exit of Tiger Global and Microsoft not only captures years of upside but also signals a maturing market where strategic exits align with larger corporate goals. For readers, the takeaway is clear: in the next 12‑24 months, digital‑payment innovations will shift from venture‑backed experimentation to regulated, high‑visibility operations—offering both opportunities and challenges for businesses and consumers alike.

No Comments